Calculate my after tax income

However you may be required to purchase course materials. Theyre taxed like regular income.

Taxable Income Formula Examples How To Calculate Taxable Income

An employer provides Form 16 to its employees at the end of the financial year.

. Now lets see more details about how weve gotten this monthly take-home sum of 3130 after extracting your tax and NI from. 25 lakh of your taxable income you pay zero tax. The Colorado income tax has one tax bracket with a maximum marginal income tax of 463 as of 2022.

For the next 5 lakhs you pay 20 ie. Wealthy individuals have to pay a small additional 09 tax on top of the normal Medicare tax. Interest in a foreign investment fund disclosure schedule Cost method IR449 2011 PDF 115KB Download form.

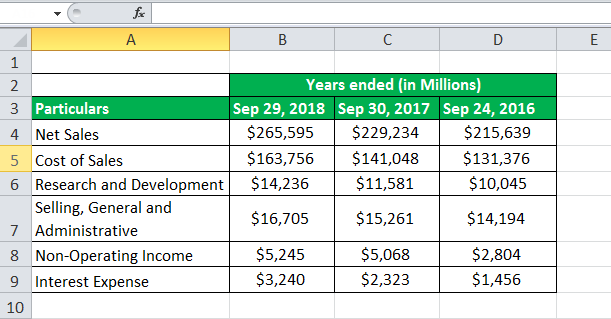

Use this tool to calculate the tax amount for financial year Fy18-19. However if you are the person who acquires the substituted property you can usually add the amount of the. Revenue of ABC private limited.

This is a break-down of how your after tax take-home pay is calculated on your 65000 yearly income. Now lets see more details about how weve gotten this monthly take-home sum of 3841 after extracting your tax and NI from. The first 9950 is taxed at 10.

Tax-free income and allowances. A companys tax provision has two parts. If you earn 50000 in a year you will take home 37554 leaving you with a net income of 3130 every month.

Calculate how much tax youll pay. That means you pay the same tax rates you pay on federal income tax. Self-assessment tax will be total tax payable minus taxes already paid ie.

Additional qualifications may be required. The Earned Income Tax Credit or EITC is a refundable tax credit for lower to middle income working families that is largely based on the number of qualifying children in your household. This is a break-down of how your after tax take-home pay is calculated on your 21000 yearly income.

From the above data we get the following information. To make things more complicated most accounting departments use Generally Accepted Accounting Principles GAAP to calculate their financial position. Theyre taxed at lower rates than short-term capital gains.

You can calculate the income tax using the Scripboxs Income Tax Calculator. Here are the most common divisions of tax basis for a rental property followed by explanations of the different methods of depreciation that generally apply. If you have a superficial loss in 2021 you cannot deduct it when you calculate your income for the year.

Qualified children for the EITC must be dependants under age 19 full-time dependant students under age 24 or fully disabled children of any age. 1 Tax rate. Income Tax Course.

To calculate the self-assessment tax first calculate the net taxable income after giving into effect every deduction and exemption. Important Documents For Tax on Income From Salary Form 16. For the first Rs.

If you earn 65000 in a year you will take home 46094 leaving you with a net income of 3841 every month. Apply additional Medicare tax of 09 if you are a high earner. Finally the formula for net operating profit after tax is derived by multiplying the EBIT with the value calculated in step 2 as shown above.

If you use the cost method to calculate your income or loss you can disclose online or use our IR449 paper form. Enrollment in or completion of the HR Block Income Tax Course is neither an offer nor a guarantee of employment. Now the companys tax rate is noted from the companys annual report.

If you earn 30000 in a year you will take home 24204 leaving you with a net income of 2017 every month. When figuring out what tax bracket youre in you look at the highest tax rate applied to the top portion of your taxable income for your filing status. Detailed Colorado state income tax rates and brackets are available on this page.

When you earn interest on your savings this interest will be treated as income and is liable for tax. Income Tax Calculator - Calculate Income Tax FY 2021-22 AY 2022-23 2022-23 2021-22 with Tax2Win Income Tax Calculator. Tax is not calculated.

Line 604 Refundable tax on CCPCs investment income. You can calculate your taxable income after adding income from salary business. Next the tax-adjusted value is calculated by subtracting the tax rate from one ie.

Is reflected in the accounting books in the period when the companys allowable tax deductions exceed current taxable income. The figure youre left with after these deductions is the non-savings part of your income that youll pay tax on. Long-term capital gains are gains on assets you hold for more than one year.

Current income tax expense and deferred income tax expense. This is a break-down of how your after tax take-home pay is calculated on your 50000 yearly income. STEP 4 Calculate Your Taxes Now one pays tax on hisher net taxable income.

Now lets see more details about how weve gotten this monthly take-home sum of 1516 after extracting your tax and NI from. 30000 After Tax Explained. The CRA may reassess an income tax and benefit return beyond the normal reassessment period in the following situations.

TDS TCS advance tax tax relief under section 87A9090A91 tax credit. This additional tax may be part of the refundable portion of Part I tax on line 450 and would be added to the refundable dividend tax on hand RDTOH or for tax years starting after 2018 to the. GAAP procedures differ in important ways from income tax accounting rules.

If you have more than 523600 in income for 2021 your income will have spilled into all seven buckets but only the money sitting in the last bucket is taxed at the highest federal income tax rate of 37. Click on Calculate to get your tax liability. Basically the applicable tax rates depend on your age and net income.

Tax on your savings income. The tax rate stands at 30. Now lets see more details about how weve gotten this monthly take-home sum of 2017 after extracting your tax and NI from.

21000 After Tax Explained. This tax applies only to income above a certain threshold below this threshold only the normal 14529 rate is applied. The federal income tax system is progressive which means that tax rates go up the greater taxable income you have.

Now calculate the total tax payable on such net taxable income. If you earn 21000 in a year you will take home 18197 leaving you with a net income of 1516 every month. Depending on your regular income tax bracket your tax rate for long-term capital gains could be as low.

The term tax bracket refers to the income ranges with differing tax rates applied to each range. Online is defined as an individual income tax DIY return non-preparer signed that was prepared online either e-filed or. Calculate profit after tax PAT for the company.

In such a case you need to add the income from all these sources and then compute the net tax payable. The threshold varies based on your filing status. You will also be able to see a comparison of your pre-budget and post-budget tax liability.

We will now get into the crucial step of calculating your tax. Calculate the depreciation for each type of property. 65000 After Tax Explained.

By understanding how the Income-tax is calculating you can estimate your taxes based on your salary or income after the annual Union Budget is presented. If you failed to pay or underpaid your estimated income taxes the previous tax year you need to fill out Form 204 to calculate and pay any penalties or fees. There is no tuition fee for the H.

An additional refundable tax of 10 23 is levied on the investment income other than deductible dividends of a CCPC. This is a break-down of how your after tax take-home pay is calculated on your 30000 yearly income. Using the brackets above you can calculate the tax for a single person with a taxable income of 41049.

50000 After Tax Explained. Tool calculates tax amount on taxable income.

Excel Formula Income Tax Bracket Calculation Exceljet

Taxable Income Formula Examples How To Calculate Taxable Income

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Annual Income Calculator

How To Calculate Net Income Formula And Examples Bench Accounting

Taxable Income Formula Calculator Examples With Excel Template

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net Income After Taxes Niat

Profit After Tax Definition Formula How To Calculate Net Profit After Tax

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Profit After Tax Definition Formula How To Calculate Net Profit After Tax

Taxable Income Formula Calculator Examples With Excel Template

How Is Taxable Income Calculated How To Calculate Tax Liability

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Calculator Examples With Excel Template

How To Calculate Income Tax In Excel

How To Calculate Net Pay Step By Step Example

How To Calculate Income Tax In Excel